Industrial ETF Investing: Manufacturing Sector Income

Imagine having a stake in the backbone of our economy, the manufacturing sector, without having to pick individual companies. Industrial ETFs offer a way to do just that, providing exposure to a diversified portfolio of companies involved in manufacturing, infrastructure development, and other industrial activities. But is this the right investment path for you?

For many investors, the allure of the manufacturing sector is tempered by the complexity of understanding individual companies, keeping up with rapidly changing technologies, and navigating the cyclical nature of industrial demand. It can be difficult to determine which companies are poised for growth and which might be struggling. The time and effort required to research individual stocks can be a significant barrier.

Industrial ETFs aim to solve these problems by offering a convenient, diversified, and potentially income-generating way to invest in the manufacturing sector. They bundle together numerous industrial stocks, reducing the risk associated with investing in a single company and providing exposure to a wide range of industrial activities.

This article explores the world of Industrial ETFs, focusing on their role in generating income within the manufacturing sector. We'll delve into the mechanics of these ETFs, examine their potential benefits and risks, and consider how they might fit into your overall investment strategy. We'll also discuss key factors to consider when choosing an industrial ETF and explore different strategies for maximizing your returns. Keywords covered include industrial ETFs, manufacturing sector, income investing, diversification, and investment strategy.

The Allure of Manufacturing Sector Income

The target of manufacturing sector income through Industrial ETFs is to provide investors with a steady stream of income generated from dividends and capital appreciation within the industrial sector. This appeals to income-seeking investors, retirees, or anyone looking to diversify their portfolio with exposure to the manufacturing industry. My first encounter with Industrial ETFs was during a period of economic expansion. I remember reading about how infrastructure projects were booming, and many analysts were predicting a surge in manufacturing activity. Intrigued, I started researching ETFs that focused on industrial companies. What initially drew me in was the potential for dividends, which seemed like a more predictable income stream compared to the volatile tech sector I was accustomed to. After some due diligence, I invested in a broadly diversified industrial ETF. Over time, I observed that the ETF's performance mirrored the overall health of the manufacturing sector. When the economy was strong, the ETF performed well, generating both dividends and capital gains. However, during periods of economic slowdown, the ETF's performance would decline. It became clear that these ETFs were closely tied to the economic cycle. The income generated from the dividends, however, provided a buffer during these downturns. This experience highlighted the importance of understanding the economic forces that drive the manufacturing sector and the cyclical nature of these investments. Industrial ETFs can offer exposure to a diverse range of industries, including aerospace, defense, construction, and transportation. Investing in these ETFs can be a strategic way to tap into the growth potential of these sectors while mitigating some of the risks associated with individual stock picking.

What are Industrial ETFs?

Industrial ETFs are exchange-traded funds that focus their investments on companies within the industrial sector. This sector encompasses a broad range of industries, including manufacturing, aerospace and defense, construction, transportation, and engineering. These ETFs offer investors a convenient way to gain exposure to a diversified portfolio of industrial stocks without having to individually select and manage each company. The primary goal of industrial ETFs is to track the performance of a specific industrial index, such as the Dow Jones U.S. Industrials Index or the S&P Industrial Select Sector Index. By replicating the composition of these indices, the ETFs aim to provide investors with returns that closely mirror the overall performance of the industrial sector. There are various types of industrial ETFs, including broad-based ETFs that cover the entire sector and specialized ETFs that focus on specific sub-industries, such as aerospace and defense or infrastructure development. The choice of ETF depends on the investor's risk tolerance, investment objectives, and views on the future prospects of different industrial sub-sectors. Investing in industrial ETFs can offer several benefits. Firstly, it provides instant diversification, reducing the risk associated with investing in a single company. Secondly, it offers a cost-effective way to access the industrial sector, as the expense ratios of ETFs are typically lower than those of actively managed mutual funds. Thirdly, ETFs are highly liquid, meaning they can be easily bought and sold on stock exchanges. However, it is important to note that industrial ETFs are still subject to market risk, and their performance can be affected by economic conditions, interest rates, and other factors. Therefore, investors should carefully consider their investment goals and risk tolerance before investing in industrial ETFs.

History and Myths of Industrial ETFs

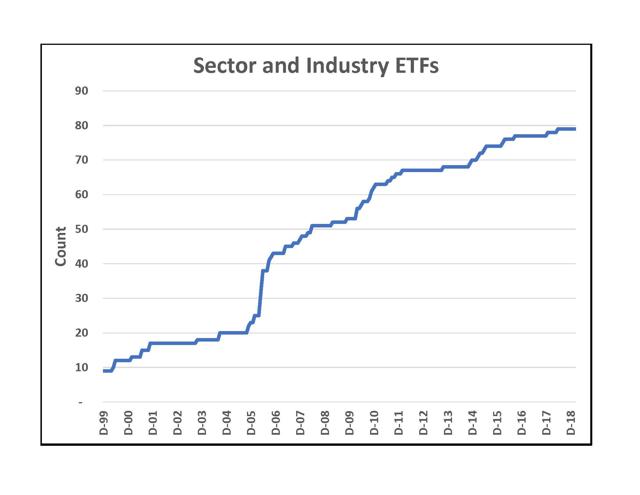

The history of industrial ETFs is relatively recent, dating back to the early 2000s when the first sector-specific ETFs were introduced. These ETFs revolutionized the way investors could access specific segments of the economy, including the industrial sector. Prior to ETFs, investors had to either invest in individual industrial stocks or rely on actively managed mutual funds, which often came with higher fees. The introduction of industrial ETFs provided a more cost-effective and transparent way to gain exposure to the industrial sector. One common myth about industrial ETFs is that they are a "safe" investment due to their diversification. While it is true that ETFs offer diversification by holding a basket of stocks, they are still subject to market risk. The performance of industrial ETFs can be affected by economic downturns, changes in government regulations, and other factors that impact the industrial sector. Another myth is that all industrial ETFs are created equal. In reality, there are significant differences between different industrial ETFs. Some ETFs may focus on specific sub-industries, while others may use different weighting methodologies or have different expense ratios. Therefore, it is important for investors to carefully research and compare different industrial ETFs before making an investment decision. A further myth is that industrial ETFs are only suitable for long-term investors. While industrial ETFs can be a valuable component of a long-term investment strategy, they can also be used by short-term traders who are looking to capitalize on short-term fluctuations in the industrial sector. However, such trading strategies require a thorough understanding of the market and a high level of risk tolerance. Understanding the history and dispelling the myths surrounding industrial ETFs is crucial for investors who want to make informed investment decisions and avoid common pitfalls.

Hidden Secrets of Industrial ETF Investing

One of the hidden secrets of industrial ETF investing lies in understanding the underlying holdings and weighting methodologies of different ETFs. While many industrial ETFs track broad market indices, the specific companies they hold and the proportion of assets allocated to each company can vary significantly. This can have a substantial impact on the ETF's performance. Another secret is to pay attention to the ETF's expense ratio and trading volume. Expense ratios can eat into your returns over time, so it is important to choose ETFs with low expense ratios. Trading volume is an indicator of liquidity, and ETFs with high trading volume are generally easier to buy and sell without significantly impacting the price. A further secret is to consider the ETF's tracking error, which measures how closely the ETF's performance matches the performance of the underlying index. A low tracking error indicates that the ETF is effectively replicating the performance of the index. Furthermore, it's crucial to understand the cyclical nature of the industrial sector. Industrial companies are often highly sensitive to economic conditions, and their performance can fluctuate significantly during periods of economic expansion and contraction. Therefore, investors should be prepared for volatility and consider using strategies such as dollar-cost averaging to mitigate risk. Finally, a hidden secret is to consider the ETF's exposure to different geographic regions. Some industrial ETFs may focus primarily on domestic companies, while others may have significant exposure to international markets. Understanding the geographic diversification of the ETF can help investors assess its potential risks and opportunities. By uncovering these hidden secrets, investors can make more informed decisions and potentially improve their returns from industrial ETF investing.

Recommendations for Industrial ETF Investing

Before diving into industrial ETF investing, it's crucial to define your investment goals and risk tolerance. Are you seeking long-term capital appreciation, dividend income, or a combination of both? Understanding your objectives will help you choose the right industrial ETF for your needs. My primary recommendation is to diversify your investments across different industrial sub-sectors. Rather than focusing solely on one area, such as aerospace and defense, consider allocating a portion of your portfolio to other areas, such as construction materials, transportation, or industrial machinery. This can help reduce your overall risk and increase your potential for long-term growth. Another recommendation is to regularly review and rebalance your portfolio. The industrial sector can be cyclical, and different sub-sectors may perform better or worse at different times. By periodically rebalancing your portfolio, you can ensure that you are maintaining your desired asset allocation and taking advantage of opportunities to buy low and sell high. I also recommend that you pay close attention to economic indicators, such as manufacturing PMI, industrial production, and consumer spending. These indicators can provide valuable insights into the health of the industrial sector and help you anticipate potential market movements. It's a great idea to consider the potential impact of government policies and regulations on the industrial sector. Changes in trade policies, environmental regulations, or infrastructure spending can have a significant impact on the profitability and growth prospects of industrial companies. Finally, I strongly recommend that you consult with a qualified financial advisor before making any investment decisions. A financial advisor can help you assess your risk tolerance, develop a personalized investment strategy, and monitor your portfolio over time.

Understanding Expense Ratios and Dividend Yields

Expense ratios and dividend yields are two critical factors to consider when evaluating industrial ETFs. The expense ratio is the annual fee charged by the ETF to cover its operating expenses. This fee is expressed as a percentage of the ETF's assets under management (AUM). A lower expense ratio means that more of your investment returns will go directly to you, rather than being eaten up by fees. Therefore, it is generally preferable to choose ETFs with lower expense ratios, all else being equal. Dividend yield, on the other hand, is a measure of the income generated by the ETF's dividend payments. It is calculated by dividing the ETF's annual dividend per share by its current share price. A higher dividend yield indicates that the ETF is generating more income relative to its share price. For income-seeking investors, dividend yield is an important consideration. However, it is important to note that dividend yields can fluctuate over time, and a high dividend yield does not necessarily guarantee future performance. When comparing industrial ETFs, it is important to consider both the expense ratio and the dividend yield in the context of your overall investment goals. If you are primarily focused on capital appreciation, a lower expense ratio may be more important than a high dividend yield. On the other hand, if you are primarily focused on generating income, a high dividend yield may be more attractive, even if the expense ratio is slightly higher. It is also important to consider the sustainability of the ETF's dividend payments. Some ETFs may generate high dividend yields by investing in riskier assets, which could jeopardize the long-term sustainability of the dividend payments. Therefore, it is important to carefully research the ETF's underlying holdings and dividend policy before making an investment decision.

Tips for Successful Industrial ETF Investing

Successful industrial ETF investing requires a disciplined approach and a thorough understanding of the market. One key tip is to conduct thorough research before investing in any industrial ETF. This includes examining the ETF's underlying holdings, expense ratio, dividend yield, and tracking error. It is also important to understand the ETF's investment strategy and how it aligns with your own investment goals. Another tip is to diversify your holdings across different industrial sub-sectors. This can help reduce your overall risk and increase your potential for long-term growth. Rather than focusing solely on one area, such as aerospace and defense, consider allocating a portion of your portfolio to other areas, such as construction materials, transportation, or industrial machinery. A further tip is to monitor your portfolio regularly and rebalance as needed. The industrial sector can be cyclical, and different sub-sectors may perform better or worse at different times. By periodically rebalancing your portfolio, you can ensure that you are maintaining your desired asset allocation and taking advantage of opportunities to buy low and sell high. It is also important to stay informed about economic trends and industry developments. Changes in economic conditions, government policies, and technological innovations can all have a significant impact on the industrial sector. By staying informed, you can make more informed investment decisions and adjust your portfolio as needed. Finally, it is important to be patient and avoid making impulsive decisions based on short-term market fluctuations. Industrial ETF investing is a long-term game, and it is important to stay focused on your long-term goals and avoid getting caught up in the day-to-day noise of the market. If you're unsure about any aspect of industrial ETF investing, consider seeking advice from a qualified financial advisor.

Tax Implications of Industrial ETF Investing

Understanding the tax implications of industrial ETF investing is crucial for maximizing your after-tax returns. Industrial ETFs can generate taxable income in the form of dividends and capital gains. Dividends are typically taxed at your ordinary income tax rate, although qualified dividends may be taxed at a lower rate. Capital gains are generated when you sell your ETF shares for a profit. The tax rate on capital gains depends on how long you held the shares. Short-term capital gains, which are generated from assets held for less than one year, are taxed at your ordinary income tax rate. Long-term capital gains, which are generated from assets held for more than one year, are taxed at a lower rate. One tax-efficient strategy for industrial ETF investing is to hold your ETFs in a tax-advantaged account, such as a 401(k) or IRA. Contributions to these accounts may be tax-deductible, and earnings and capital gains may be tax-deferred or tax-free, depending on the type of account. Another strategy is to use tax-loss harvesting. This involves selling losing investments to offset capital gains from winning investments. By carefully managing your tax liabilities, you can significantly improve your after-tax returns from industrial ETF investing. It is important to keep accurate records of your ETF transactions and consult with a tax professional for personalized advice. Tax laws can be complex and are subject to change, so it is important to stay informed about the latest rules and regulations. This awareness allows you to make informed decisions about your investment strategy.

Fun Facts of Industrial ETF Investing

Did you know that the industrial sector is one of the oldest and most fundamental sectors of the global economy? From manufacturing to transportation to construction, the industrial sector is responsible for producing the goods and services that we rely on every day. Industrial ETFs provide a way to invest in this vital sector and participate in its growth. Another fun fact is that industrial ETFs can offer exposure to a wide range of innovative technologies. Many industrial companies are at the forefront of developing new technologies, such as automation, robotics, and artificial intelligence. By investing in industrial ETFs, you can gain exposure to these cutting-edge technologies and potentially benefit from their future growth. Furthermore, industrial ETFs are not just limited to developed markets. There are also industrial ETFs that focus on emerging markets, such as China, India, and Brazil. These ETFs can provide investors with exposure to the rapidly growing industrial sectors in these countries. It's really something that industrial ETFs can even track niche areas like water infrastructure or renewable energy equipment manufacturing. This level of specificity allows investors to align their investments with particular causes or industries they believe in. The ticker symbols themselves can be a source of amusement or intrigue. Some ETFs have cleverly chosen ticker symbols that relate to their underlying investment theme. Overall, industrial ETF investing offers a fascinating glimpse into the world of manufacturing, innovation, and global economic growth.

How to Choose the Right Industrial ETF

Choosing the right industrial ETF requires careful consideration of several factors. First and foremost, it is important to understand your own investment goals and risk tolerance. Are you seeking long-term capital appreciation, dividend income, or a combination of both? Are you comfortable with a high level of volatility, or do you prefer a more conservative approach? Once you have a clear understanding of your investment goals and risk tolerance, you can begin to narrow down your options. Next, you should examine the ETF's underlying holdings. What types of companies does the ETF invest in? Does the ETF focus on a specific sub-sector of the industrial sector, such as aerospace and defense or construction materials? It is important to choose an ETF that aligns with your views on the future prospects of different industrial sub-sectors. You should also pay close attention to the ETF's expense ratio. The expense ratio is the annual fee charged by the ETF to cover its operating expenses. A lower expense ratio means that more of your investment returns will go directly to you, rather than being eaten up by fees. Therefore, it is generally preferable to choose ETFs with lower expense ratios, all else being equal. Another important factor to consider is the ETF's liquidity. Liquidity refers to how easily the ETF shares can be bought and sold without significantly impacting the price. ETFs with high trading volumes are generally more liquid than ETFs with low trading volumes. You should also consider the ETF's tracking error, which measures how closely the ETF's performance matches the performance of the underlying index. A low tracking error indicates that the ETF is effectively replicating the performance of the index. Finally, it is important to read the ETF's prospectus carefully before investing. The prospectus provides detailed information about the ETF's investment strategy, risks, and fees.

What If Industrial ETF Investing Goes Wrong?

Even with careful planning and research, industrial ETF investing can sometimes go wrong. Economic downturns, unexpected industry disruptions, and unforeseen company-specific events can all negatively impact the performance of your industrial ETFs. One possible scenario is a significant decline in the overall market. If the stock market experiences a sharp correction or bear market, industrial ETFs are likely to decline in value along with the broader market. In this scenario, it is important to remain calm and avoid making impulsive decisions. It may be tempting to sell your ETF shares to cut your losses, but this could lock in your losses and prevent you from participating in any future recovery. Another possible scenario is a downturn in the industrial sector. If the industrial sector experiences a slowdown due to factors such as declining demand, rising input costs, or increased competition, industrial ETFs are likely to underperform the broader market. In this scenario, it may be necessary to re-evaluate your investment strategy and consider reallocating your assets to other sectors. A further risk is company-specific events. Even though industrial ETFs offer diversification, they are still subject to the risks associated with the individual companies they hold. If a major company within the ETF experiences a significant setback, such as a product recall, a financial scandal, or a regulatory investigation, the ETF's performance could be negatively impacted. What can you do? Always start by reviewing your investment strategy to see if it is still appropriate for your current situation. Consider rebalancing your portfolio to reduce your exposure to industrial ETFs. In some cases, it may be necessary to sell your ETF shares and reallocate your assets to other sectors or asset classes.

Listicle of Industrial ETF Investing

Here's a quick list of key things to know about Industrial ETF Investing:

- Diversification: Industrial ETFs offer exposure to a broad range of industrial companies, reducing the risk associated with investing in individual stocks.

- Convenience: ETFs are easy to buy and sell on stock exchanges, providing a convenient way to access the industrial sector.

- Cost-Effectiveness: ETFs typically have lower expense ratios than actively managed mutual funds.

- Transparency: ETFs disclose their holdings on a daily basis, providing investors with transparency into their investments.

- Liquidity: ETFs are highly liquid, meaning they can be easily bought and sold without significantly impacting the price.

- Income Potential: Many industrial ETFs pay dividends, providing investors with a stream of income.

- Sector-Specific Exposure: Industrial ETFs allow investors to target specific sub-sectors of the industrial sector, such as aerospace and defense or construction materials.

- Global Exposure: Some industrial ETFs offer exposure to industrial companies in emerging markets.

- Risk Management: ETFs can be used to manage risk by diversifying your portfolio and reducing your exposure to individual stocks.

- Long-Term Growth: Industrial ETFs can be a valuable component of a long-term investment strategy.

Question and Answer

Here are some frequently asked questions about industrial ETF investing:

Q: What are the main benefits of investing in industrial ETFs?

A: The main benefits include diversification, convenience, cost-effectiveness, and exposure to a wide range of industrial companies.

Q: What are the risks associated with industrial ETF investing?

A: The risks include market risk, economic risk, company-specific risk, and the potential for lower returns than actively managed investments.

Q: How do I choose the right industrial ETF for my needs?

A: Consider your investment goals, risk tolerance, the ETF's underlying holdings, expense ratio, liquidity, and tracking error.

Q: What are some strategies for maximizing returns from industrial ETF investing?

A: Diversify your holdings, rebalance your portfolio regularly, stay informed about economic trends, and consider tax-efficient investment strategies.

Conclusion of Industrial ETF Investing

Industrial ETFs present a compelling opportunity for investors seeking income and exposure to the manufacturing sector. By offering diversification, convenience, and potential for dividend income, these ETFs can be a valuable addition to a well-rounded portfolio. However, it's crucial to conduct thorough research, understand the risks involved, and align your investment strategy with your individual financial goals. Remember to carefully evaluate expense ratios, dividend yields, and the underlying holdings of different ETFs to make informed decisions. Whether you're a seasoned investor or just starting out, industrial ETFs offer a dynamic way to participate in the growth and income potential of the manufacturing sector.

Post a Comment