Structured Product Investing: Complex Income Strategies

Ever wondered if there's a way to boost your investment income without diving headfirst into the stock market's rollercoaster? There is, and it involves a bit of financial engineering. It's called structured product investing, and it can offer some interesting opportunities for those seeking complex income strategies.

Navigating the world of finance can feel like walking through a maze, especially when you're aiming for something beyond the standard savings account or stock portfolio. It's tough trying to decipher complex financial instruments, assess their true risk, and figure out if they actually align with your long-term financial goals. You are not alone feeling like this.

This guide aims to shed light on the potential of structured products as a means to generate income. We'll explore how they work, what to consider before investing, and whether they're a good fit for your individual investment strategy. If you're looking for innovative ways to enhance your investment income, you've come to the right place.

Throughout this guide, we've explored the world of structured products, focusing on their potential as complex income strategies. We've touched on their definition, history, the secrets they hold, and provided recommendations for getting started. Remember, investing in structured products requires a thorough understanding of your risk tolerance and investment goals. Always do your due diligence and seek professional advice before making any investment decisions. Keep an eye out for hidden secrets, and hopefully this has been educational to you.

Understanding Structured Products

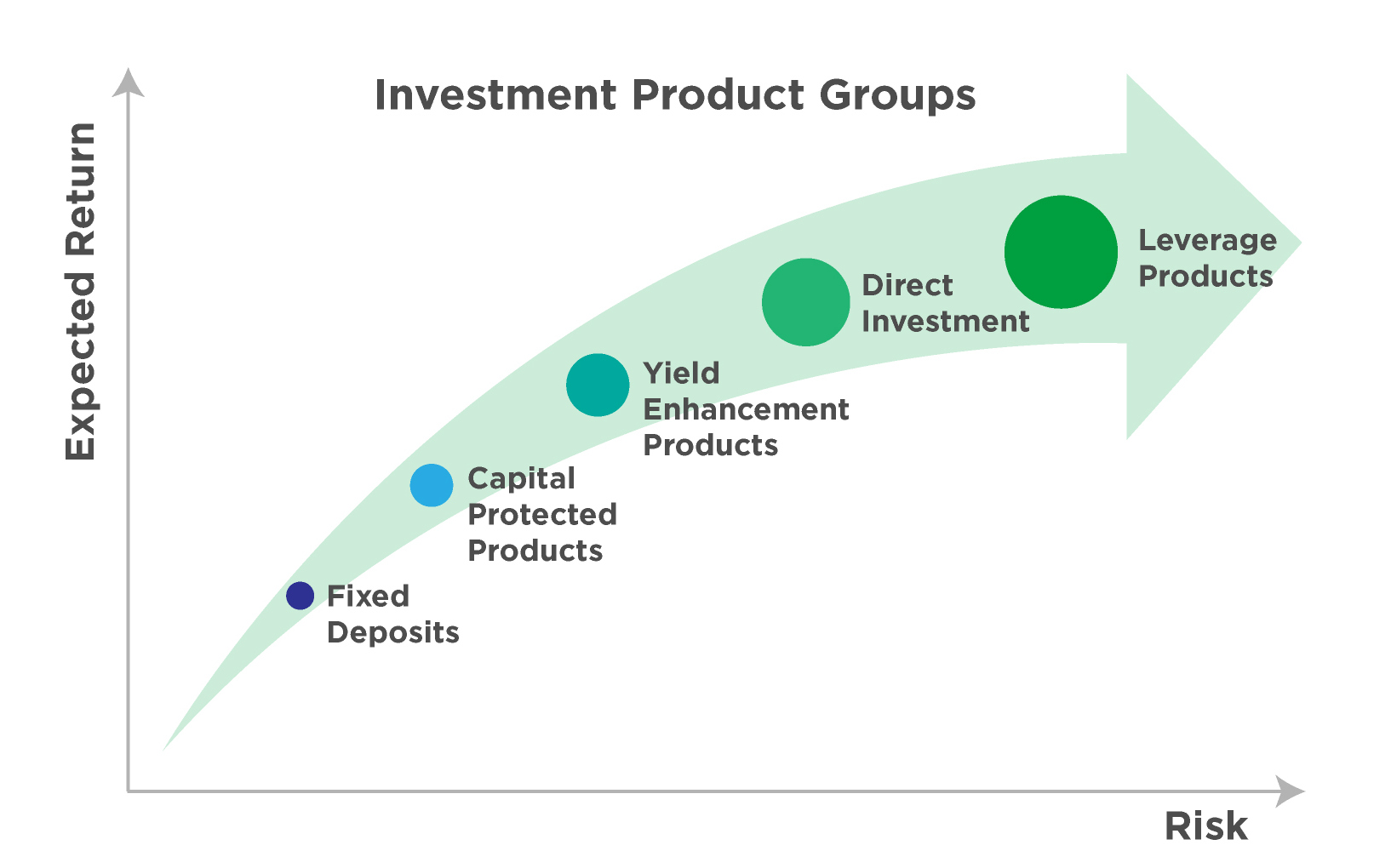

Structured products can be incredibly useful tools. I remember when I first encountered them, I was completely overwhelmed by the jargon. It felt like learning a new language! But once I started to understand the basic building blocks, things became much clearer. Structured products, at their core, are pre-packaged investments that combine different assets, often derivatives, to achieve a specific risk-return profile. For example, a structured note might offer a fixed coupon payment linked to the performance of an equity index, but with downside protection. This means you get a regular income stream, but your principal is partially shielded from market crashes. The target of understanding structured products is for investors to consider the risk and returns of structured products based on their own individual circumstances. Structured products may not be suitable for all investors, and they involve risks such as market risk, credit risk, liquidity risk, and complexity. Investors should carefully consider whether structured products are right for them and consult with a qualified financial advisor before making any investment decisions. Some structured products may also have limited liquidity, meaning that investors may not be able to sell them easily before maturity. Investors should be aware of these risks before investing in structured products.Structured products can be tailored to a wide range of investment goals, from generating income to participating in market upside while limiting downside risk. However, it's crucial to understand the underlying mechanics and potential risks before investing.

What are Complex Income Strategies?

Complex income strategies, in the context of structured products, refer to the techniques used to design these investments to generate regular income streams. This often involves combining features like coupon payments, barrier levels, and participation rates to create a payoff structure that aligns with an investor's desired income profile. These strategies often use derivatives, such as options, to engineer specific risk-reward characteristics. For example, a structured product might use a call option to participate in the upside of an asset while simultaneously selling a put option to generate income. The income generated from selling the put option helps to offset the cost of the call option and can provide a higher overall yield. The target of complex income strategies is to generate the income based on what you are looking for. Understanding the nuances of these strategies is key to assessing the suitability of a structured product for your portfolio. It's about deciphering how the product generates income, what risks are involved, and whether the potential rewards justify those risks. Investors should carefully consider the risks and benefits of complex income strategies before investing, and consult with a financial advisor to determine if they are appropriate for their investment goals.

History and Myths of Structured Products

Structured products have been around for decades, evolving from relatively simple combinations of bonds and derivatives to highly sophisticated instruments. Their origins can be traced back to the 1980s, with the emergence of indexed-linked notes. However, they gained significant popularity in the 2000s as investors sought alternatives to traditional fixed income investments. One of the biggest myths surrounding structured products is that they are "too good to be true." While they can offer attractive features like principal protection or enhanced yields, it's crucial to remember that these benefits often come with trade-offs. For instance, a product with principal protection may offer lower returns than a traditional investment. The history of structured products is complex and filled with ups and downs. They have been used to achieve a variety of investment goals, from generating income to hedging risk. However, they have also been criticized for their complexity and lack of transparency. It's important to understand the history and myths of structured products before investing in them. By doing so, you can avoid common pitfalls and make informed investment decisions.

Hidden Secrets of Structured Products

One of the biggest "secrets" of structured products is the level of complexity involved in their pricing and construction. Understanding the underlying components and how they interact is crucial to assessing their true value. Another hidden aspect is the potential for conflicts of interest. The firms that design and distribute structured products may have incentives to structure them in ways that benefit themselves, rather than the investor. Therefore, it's essential to conduct thorough due diligence and seek independent advice before investing. The hidden secrets are also about the potential for tax implications, fees, and commissions. Structured products can be complex and it's important to understand all of the costs involved before investing. It's important to be aware of these hidden secrets and to do your research before investing in any structured product. Don't be afraid to ask questions and seek advice from a qualified financial advisor. This will help you make informed investment decisions and avoid potential pitfalls. The more you understand, the better equipped you'll be to navigate the world of structured products successfully.

Recommendation of Structured Products

Whether or not structured products are a good fit for your portfolio depends entirely on your individual circumstances, risk tolerance, and investment goals. If you're seeking to generate income in a low-yield environment, and you're comfortable with a certain level of complexity, they may be worth considering. However, it's crucial to approach them with caution and conduct thorough due diligence. Before investing in any structured product, be sure to carefully review the product documentation, understand the underlying mechanics, and assess the potential risks. It's also a good idea to seek advice from a qualified financial advisor who can help you determine if the product is appropriate for your portfolio. Some other things to consider are your investment timeline, your tax situation, and your liquidity needs. Be sure to understand the fees and expenses associated with the product before you invest. It's also important to note that structured products are not FDIC insured and are subject to market risk. It's important to weigh the potential benefits against the risks before making a decision.

Assessing Risk Tolerance

One of the most critical steps in evaluating structured products is assessing your own risk tolerance. This involves understanding your capacity to withstand potential losses and your willingness to accept risk in pursuit of higher returns. Ask yourself: How would I react if the underlying asset declined significantly in value? Am I comfortable with the possibility of losing some or all of my investment? What is my time horizon for this investment? Am I willing to hold the product until maturity, or do I need the flexibility to sell it earlier? By answering these questions honestly, you can gain a better understanding of your risk tolerance and determine whether structured products are a suitable investment for you. Risk tolerance can change over time, so it's important to reassess it periodically and adjust your investment strategy accordingly. Factors such as age, financial situation, and investment goals can all influence your risk tolerance. A qualified financial advisor can help you assess your risk tolerance and develop an investment plan that aligns with your individual needs and circumstances.Remember, investing in structured products should be a calculated decision based on your own personal circumstances and risk appetite.

Tips of Structured Product Investing

Investing in structured products requires a strategic approach. Start by thoroughly researching the product and the issuing institution. Understand the underlying assets, the payout structure, and any embedded risks. Diversification is also crucial. Don't put all your eggs in one basket; spread your investments across different asset classes and structured products. Consider your investment horizon and liquidity needs. Structured products often have specific maturity dates, and early redemption may result in losses. Stay informed about market conditions and how they might impact your investment. Regularly review your portfolio and adjust your strategy as needed. Don't be afraid to seek professional advice. A qualified financial advisor can provide valuable insights and help you make informed investment decisions. Understand the fees and expenses associated with the product before you invest. It's also important to remember that structured products are not FDIC insured and are subject to market risk. Some products may have complex features or lack transparency. Make sure you understand the product fully before investing. With the proper knowledge, approach, and plan, these are the tips that will help you.

Understanding the Underlying Assets

A critical aspect of successful structured product investing is understanding the underlying assets to which the product is linked. This involves researching the asset's historical performance, volatility, and potential future outlook. Are you investing in an equity index, a commodity, or a currency? What are the key factors that drive its price movements? How has it performed in different market conditions? By understanding the underlying assets, you can better assess the potential risks and rewards of the structured product. It's also important to understand how the product's payout is linked to the performance of the underlying assets. Does the product offer full participation in the asset's upside, or is it capped at a certain level? Does it offer any downside protection, and if so, how does it work? The more you understand about the underlying assets and the product's payout structure, the better equipped you'll be to make informed investment decisions. Look at how the underlying assets are diversified so that your eggs are not all in one basket. Investing based on underlying assets will help you earn more.

Fun Facts of Structured Product Investing

Did you know that structured products can be customized to meet specific investor needs? This allows for a high degree of flexibility in tailoring investments to individual risk profiles and market outlooks. Another fun fact is that structured products are used by a wide range of investors, from institutional investors to individual retail investors. They can be a valuable tool for portfolio diversification and income generation. But the most fun fact of all: structured products are not as boring as they sound! They can be a fascinating way to learn about financial markets and innovative investment strategies. The word "structured product" might seem boring, but it is actually not. Structured products is more fun than you think because it is a way to diversify your income streams and portfolio. However, always be careful and cautious when investing.

How to Structured Product Investing

Getting started with structured product investing involves a few key steps. First, educate yourself about the different types of structured products available and their underlying mechanics. Second, assess your risk tolerance and investment goals. Third, research different structured products and compare their features, risks, and potential rewards. Fourth, work with a qualified financial advisor who can help you select products that are appropriate for your portfolio. Fifth, carefully review the product documentation before investing. Sixth, monitor your investments regularly and adjust your strategy as needed. Seventh, be prepared to hold the product until maturity to maximize your potential returns. Understand the steps to start structured product investing. When beginning, seek advice from a qualified professional who can help guide you on the right way. Investing with structured products is not as easy as it seems. Therefore, proper education is necessary.

What if Structured Product Investing

What if structured product investing goes wrong? It's essential to consider the potential downsides before investing. If the underlying asset performs poorly, you could lose some or all of your investment. If the issuing institution defaults, you could also lose your investment. It's important to understand the risks and have a plan in place to mitigate them. Always be careful, always be cautious, and always be prepared to invest. It's not all the time that structured product investing can be profitable. There are also chances that you can lose some or all of your money. It's important to be aware of the risks and rewards of structured product investing before you invest. If you're considering investing in structured products, be sure to speak with a qualified financial advisor who can help you understand the risks and rewards and determine if they're right for you. Always prepare for the worst. What if you lose money? What if you do not achieve your target?

Listicle of Structured Product Investing

Here's a quick listicle of key considerations for structured product investing: 1. Understand the underlying assets.

2. Assess your risk tolerance.

3. Diversify your investments.

4. Review the product documentation.

5. Work with a qualified financial advisor.

6. Monitor your investments regularly.

7. Be prepared to hold the product until maturity.

8. Understand the potential downsides.

9. Stay informed about market conditions.

10. Don't put all your eggs in one basket. Remember, structured products can be a valuable tool for income generation and portfolio diversification, but they should be approached with caution and careful planning. This quick list will help you understand more about structured product investing. When beginning, it is always important to seek advice from a qualified professional who can help guide you on the right way.

Question and Answer of Structured Product Investing

Q: What are the main benefits of structured product investing?

A: Potential benefits include income generation, downside protection, and portfolio diversification.

Q: What are the main risks of structured product investing?

A: Potential risks include market risk, credit risk, liquidity risk, and complexity.

Q: Are structured products suitable for all investors?

A: No, structured products are not suitable for all investors. They are best suited for investors who understand the risks and have a long-term investment horizon.

Q: How can I learn more about structured product investing?

A: You can consult with a qualified financial advisor, read articles and books on the topic, and attend seminars or webinars.

Conclusion of Structured Product Investing: Complex Income Strategies

Structured products, offering complex income strategies, present both opportunities and challenges for investors. Their ability to generate income and potentially provide downside protection can be attractive, but their complexity demands thorough understanding and careful consideration. By educating yourself, assessing your risk tolerance, and working with a qualified advisor, you can make informed decisions about whether structured products are a suitable addition to your investment portfolio.

Post a Comment