Closed-End Fund Investing: High Yield Income Strategy

Imagine generating a steady stream of income from your investments, even in a challenging market. Closed-end funds (CEFs) offer a unique avenue to potentially achieve this, particularly through a high-yield income strategy. But is it the right fit for you?

Many investors find themselves searching for higher yields in today's low-interest-rate environment. Traditional fixed-income investments may not provide the returns needed to meet financial goals, and the stock market's volatility can be unsettling. Navigating the complexities of different investment vehicles and understanding their associated risks can also feel overwhelming.

This blog post aims to demystify closed-end fund investing, specifically focusing on how you can use them to build a high-yield income strategy. We'll explore what CEFs are, how they work, the potential benefits and risks, and how to determine if they align with your investment objectives.

In essence, we'll delve into the world of closed-end funds, uncovering their potential for generating high income. We will tackle their unique structure, explore various strategies for maximizing yield, and address common concerns surrounding risk management. Get ready to discover if closed-end fund investing, with its high-yield potential, could be the missing piece in your investment portfolio.

Understanding Closed-End Funds: A Personal Perspective

I remember when I first stumbled upon closed-end funds. I was searching for ways to boost the income generated from my retirement portfolio. Bonds were yielding next to nothing, and I was hesitant to dive headfirst into riskier high-growth stocks. A financial advisor suggested I look into CEFs, specifically those focusing on high-yield debt. Honestly, I was intimidated. The name itself, "closed-end fund," sounded exclusive and complicated. After some research, however, I realized they weren't as scary as they seemed. They function much like mutual funds or ETFs in that they pool capital from investors to purchase a portfolio of assets. The key difference lies in their structure. Unlike open-end funds that can issue new shares continuously, CEFs issue a fixed number of shares during an initial public offering (IPO). These shares then trade on the stock exchange like any other stock. This limited supply can lead to the fund's market price trading at a premium or discount to its net asset value (NAV), which represents the total value of the fund's underlying holdings per share. This premium/discount dynamic is a crucial factor to consider when evaluating CEFs, particularly when employing a high-yield income strategy. The discount might make the fund appear cheaper and boost your yield on investment but could also indicate underlying problems within the fund's portfolio.

What is a High-Yield Income Strategy with CEFs?

A high-yield income strategy using closed-end funds involves investing in CEFs that primarily hold assets known for generating higher-than-average income. These assets often include corporate bonds (especially those rated below investment grade, often referred to as "junk bonds"), preferred stocks, mortgage-backed securities, and even dividend-paying common stocks. The goal is to create a portfolio that produces a substantial stream of income for the investor. However, it's crucial to understand that higher yield often comes with higher risk. Below-investment-grade bonds, for instance, carry a greater risk of default. Mortgage-backed securities can be sensitive to interest rate changes. And even preferred stocks can be impacted by company-specific financial difficulties. Therefore, a successful high-yield income strategy with CEFs requires careful due diligence, diversification, and a clear understanding of your own risk tolerance. Diversification helps to mitigate the risk associated with any single holding. Careful monitoring of the fund's performance, management team, and underlying asset allocation is also essential. Consider researching the fund's expense ratio, as these costs can erode your returns over time. Ultimately, the goal is to strike a balance between maximizing income and minimizing risk.

The History and Myths of High-Yield CEF Investing

Closed-end funds have been around for over a century, with their origins tracing back to the 19th century in the United Kingdom. They were initially used to finance infrastructure projects and global investments. The concept of using CEFs for high-yield income strategies gained popularity in the latter half of the 20th century as the market for high-yield bonds and other income-producing assets expanded. One common myth is that all CEFs are inherently risky. While it's true that many high-yield CEFs invest in riskier assets, not all CEFs are created equal. Some focus on more conservative asset classes like investment-grade bonds, and their risk profiles are significantly different. Another myth is that a high distribution rate (the percentage of the fund's assets paid out as income) automatically equates to a good investment. A high distribution rate can sometimes be unsustainable if the fund isn't generating enough income from its underlying assets, leading to a decline in the fund's NAV over time. Also, investors sometimes believe that the discount to NAV is always a buying opportunity. While a discount can be attractive, it's crucial to understand why the discount exists. It could be a sign of underlying problems within the fund, such as poor management or a deteriorating portfolio. Thorough research and a critical approach are essential to separating fact from fiction in the world of high-yield CEF investing.

The Hidden Secrets of Maximizing Yield in CEFs

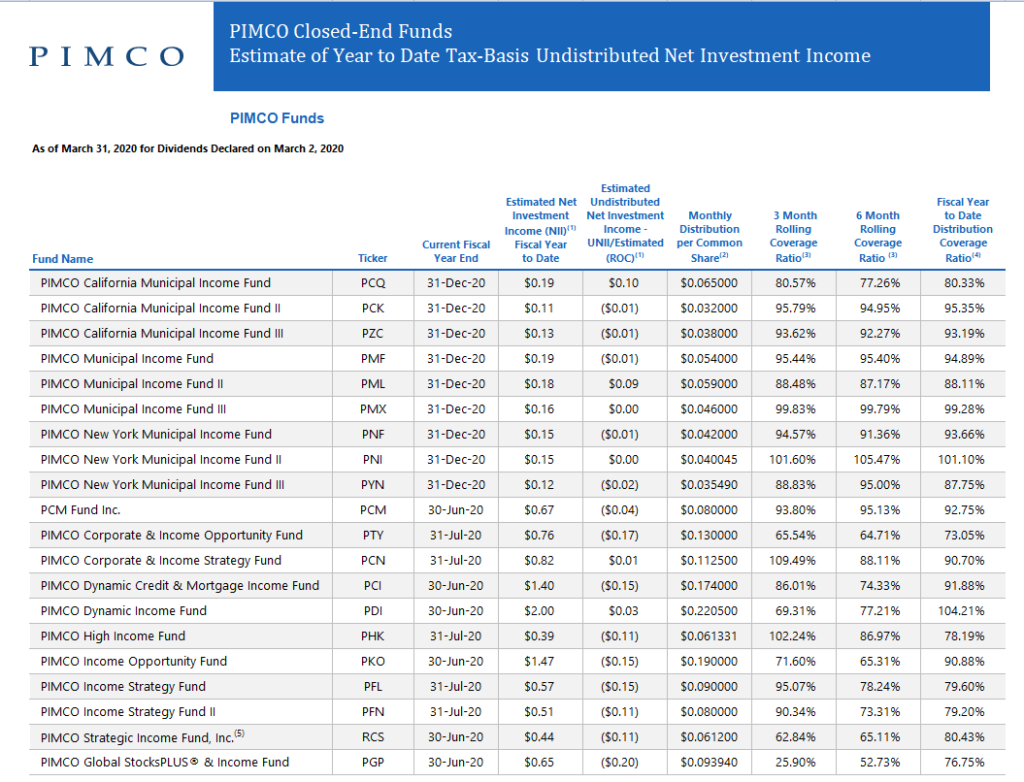

One often overlooked secret to maximizing yield in closed-end funds is understanding the concept of "managed distribution." Many CEFs aim to maintain a consistent distribution rate, regardless of the fund's current income generation. To achieve this, they may sometimes pay out distributions that include return of capital (ROC). ROC is not income; it's a return of the investor's original investment. While ROC can be tax-advantaged in some cases, it also reduces the fund's NAV over time. Savvy investors look for CEFs that primarily generate their distributions from net investment income and capital gains, rather than relying heavily on ROC. Another secret lies in identifying CEFs that are trading at attractive discounts to NAV. These discounts can provide a margin of safety and potentially lead to capital appreciation if the discount narrows over time. However, it's essential to investigate the reasons behind the discount to ensure it's not indicative of deeper problems. Furthermore, paying attention to the fund's leverage ratio is crucial. Leverage can amplify both gains and losses, so it's important to understand how much leverage the fund is using and whether it aligns with your risk tolerance. Finally, consider the fund's expense ratio and management fees. Even small differences in fees can have a significant impact on your long-term returns.

Recommendations for Building a High-Yield CEF Portfolio

Before diving into high-yield CEF investing, it's crucial to assess your risk tolerance and investment goals. How much income do you need, and how much risk are you willing to take to achieve that income? Start by researching different CEF sectors that align with your objectives. For example, you might consider CEFs that invest in high-yield bonds, preferred stocks, or real estate investment trusts (REITs). Diversification is key. Don't put all your eggs in one basket. Spread your investments across multiple CEFs in different sectors to reduce your overall risk. When evaluating CEFs, pay close attention to their distribution rates, NAV performance, expense ratios, and management teams. Look for funds with a proven track record of generating consistent income and managing risk effectively. Also, consider the fund's leverage ratio and its use of return of capital. Read the fund's prospectus carefully to understand its investment strategy and risks. Once you've identified a few promising CEFs, consider dollar-cost averaging. Invest a fixed amount of money at regular intervals, regardless of the fund's share price. This can help you to smooth out your returns and reduce the risk of buying at the top. Finally, monitor your portfolio regularly and make adjustments as needed. The market is constantly changing, so it's important to stay informed and adapt your strategy accordingly. Remember, high-yield CEF investing is not a "set it and forget it" approach. It requires ongoing due diligence and active management.

Understanding Distribution Rates vs. Yield to Maturity

When evaluating high-yield closed-end funds, it's easy to get caught up in the distribution rate. This figure, usually expressed as a percentage, represents the annual income distribution divided by the fund's current share price. While a high distribution rate can be enticing, it doesn't tell the whole story. It's crucial to also consider the fund's yield to maturity (YTM), particularly if the fund invests in bonds. YTM is a more comprehensive measure of a bond's total return, taking into account not only the interest payments but also any capital gains or losses that may occur if the bond is held until maturity. For a CEF that invests in bonds, the YTM of its underlying portfolio can provide a better indication of its long-term income-generating potential. A high distribution rate coupled with a low YTM might suggest that the fund is paying out more than it's earning, potentially eroding its NAV over time. Also, understanding the composition of the distributions is critical. Is the distribution primarily from net investment income, capital gains, or return of capital? A fund that relies heavily on return of capital to maintain its distribution rate may not be sustainable in the long run. Therefore, a thorough analysis of both the distribution rate and the YTM, along with the composition of the distributions, is essential for making informed investment decisions in high-yield CEFs.

Tips for Navigating the Volatility of CEF Prices

Closed-end funds, unlike open-end mutual funds, trade on exchanges like stocks. This means their prices can fluctuate based on supply and demand, often independently of their underlying net asset value (NAV). This volatility can be unnerving, especially for new CEF investors. One key tip is to focus on the long term. Don't get too caught up in short-term price swings. CEFs are generally best suited for investors with a longer time horizon who are looking for a steady stream of income. Another tip is to take advantage of market dips. When CEF prices fall, their yields tend to rise, making them potentially more attractive investments. However, be sure to do your due diligence and understand why the price is falling before buying. Is it a temporary market correction, or is there a fundamental problem with the fund? Also, consider using limit orders when buying or selling CEFs. A limit order allows you to specify the price at which you're willing to buy or sell, helping you to avoid getting caught up in sudden price swings. Furthermore, diversification can help to reduce the impact of volatility on your portfolio. By spreading your investments across multiple CEFs in different sectors, you can cushion the blow from any one fund's price decline. Finally, remember that patience is key. CEF prices can be volatile, but over the long term, they have the potential to provide attractive returns and a steady stream of income.

Tax Implications of CEF Distributions

Understanding the tax implications of closed-end fund distributions is crucial for maximizing your after-tax returns. CEF distributions can be classified into three main categories: ordinary income, capital gains, and return of capital (ROC). Ordinary income is taxed at your individual income tax rate. Capital gains are taxed at either short-term or long-term capital gains rates, depending on how long the fund held the underlying assets. ROC is not taxed as income; instead, it reduces your cost basis in the fund. This means you'll pay more in capital gains taxes when you eventually sell your shares. The tax treatment of CEF distributions can vary depending on the fund's investment strategy and the types of assets it holds. For example, a CEF that invests primarily in municipal bonds will typically generate tax-exempt income. It's important to review the fund's tax information each year to understand how your distributions will be taxed. You should also consider the location of your CEF investments. Holding CEFs in a tax-advantaged account, such as a 401(k) or IRA, can help you to defer or eliminate taxes on your distributions. However, be aware of any potential penalties for early withdrawals from these accounts. It's always a good idea to consult with a tax advisor to discuss your specific situation and develop a tax-efficient investment strategy.

Fun Facts About Closed-End Fund Investing

Did you know that some closed-end funds have been around for over 150 years? These funds have weathered numerous market cycles and economic downturns, demonstrating their resilience as investment vehicles. Another fun fact is that CEFs can sometimes trade at discounts to their net asset value (NAV) that are larger than the fund's annual distribution rate. This means that you could potentially earn back your entire investment in just a few years if the discount closes. However, it's important to remember that discounts can also persist for extended periods, and there's no guarantee that they will ever close. Also, CEFs offer exposure to a wide range of asset classes, including those that are difficult for individual investors to access directly. For example, you can invest in CEFs that specialize in emerging market debt, senior loans, or even private equity. This diversification can help you to build a more well-rounded and potentially higher-yielding portfolio. Furthermore, CEF managers often have specialized expertise in their respective asset classes, which can give them an edge in identifying undervalued opportunities. Finally, CEFs can be a valuable tool for generating income in retirement, providing a steady stream of cash flow to help meet your living expenses. However, it's crucial to carefully consider your risk tolerance and investment goals before investing in CEFs, and to diversify your portfolio to mitigate risk.

How to Choose the Right Closed-End Funds

Choosing the right closed-end funds requires a combination of research, analysis, and a clear understanding of your investment goals and risk tolerance. Start by identifying the asset classes that align with your objectives. Are you looking for income, capital appreciation, or a combination of both? Do you prefer fixed-income investments, equities, or alternative assets? Once you've narrowed down your asset class, research different CEFs that specialize in that area. Pay close attention to their investment strategies, track records, expense ratios, and management teams. Look for funds with a consistent history of generating strong returns and managing risk effectively. Also, consider the fund's distribution rate and the sustainability of its distributions. Is the fund generating its distributions from net investment income and capital gains, or is it relying heavily on return of capital? Analyze the fund's discount or premium to NAV. Is the fund trading at an attractive discount, or is it overpriced? Investigate the reasons behind the discount or premium to ensure it's justified. Review the fund's leverage ratio. How much leverage is the fund using, and does it align with your risk tolerance? Read the fund's prospectus carefully to understand its investment strategy, risks, and fees. Finally, consider diversifying your CEF portfolio across multiple funds in different sectors to reduce your overall risk. Remember, choosing the right CEFs is a process that requires ongoing due diligence and active management.

What if Closed-End Fund Investing Goes Wrong?

Even with careful research and due diligence, things can sometimes go wrong in closed-end fund investing. Market conditions can change, investment strategies can falter, and unforeseen events can occur. It's important to be prepared for the possibility of losses and to have a plan in place for managing those losses. One potential risk is a decline in the fund's net asset value (NAV). This can happen if the underlying assets in the fund's portfolio lose value. Another risk is a widening of the fund's discount to NAV. This can occur if investor sentiment turns negative or if there are concerns about the fund's management or investment strategy. In either case, you could experience a loss of capital. If you experience a significant loss in a CEF, it's important to assess the situation and determine the cause of the loss. Was it a temporary market correction, or is there a fundamental problem with the fund? If you believe the problem is temporary, you might consider holding onto the fund and waiting for it to recover. However, if you believe the problem is more serious, you might consider selling the fund and reallocating your capital to other investments. It's also important to remember that diversification can help to mitigate the risk of losses in CEF investing. By spreading your investments across multiple funds in different sectors, you can cushion the blow from any one fund's poor performance. Finally, don't be afraid to seek professional advice from a financial advisor. They can help you to assess your risk tolerance, develop a sound investment strategy, and manage your losses effectively.

A Quick List of Key Considerations Before Investing in High-Yield CEFs

Here's a quick rundown of points to consider before jumping into high-yield CEFs:

- Risk Tolerance: High yield often means high risk. Are you comfortable with potential losses?

- Investment Goals: What are you trying to achieve with these investments? Income, growth, or both?

- Due Diligence: Research the fund's investment strategy, track record, and management team.

- Expense Ratios: How much are you paying in fees? High fees can erode your returns.

- Distribution Rate: Is the distribution rate sustainable? Is it supported by net investment income and capital gains, or is it reliant on return of capital?

- Discount/Premium to NAV: Is the fund trading at an attractive discount, or is it overpriced? Understand the reasons behind the discount or premium.

- Leverage: How much leverage is the fund using? Leverage can amplify both gains and losses.

- Diversification: Don't put all your eggs in one basket. Spread your investments across multiple funds in different sectors.

- Tax Implications: Understand the tax treatment of CEF distributions.

- Long-Term Perspective: CEFs are generally best suited for investors with a longer time horizon.

Question and Answer Section

Q: What are the main benefits of investing in high-yield closed-end funds?

A: High-yield CEFs offer the potential for generating a higher stream of income compared to traditional fixed-income investments. They can also provide access to asset classes that are difficult for individual investors to access directly. Furthermore, they may trade at discounts to NAV, offering potential capital appreciation opportunities.

Q: What are the key risks associated with high-yield closed-end funds?

A: The main risks include market risk, credit risk, interest rate risk, leverage risk, and management risk. High-yield CEFs often invest in riskier assets, such as below-investment-grade bonds, which are more susceptible to defaults. Leverage can amplify both gains and losses. And poor management decisions can negatively impact the fund's performance.

Q: How can I diversify my high-yield CEF portfolio?

A: Diversification can be achieved by investing in multiple CEFs across different sectors, asset classes, and geographic regions. This can help to reduce your overall risk and improve your portfolio's stability.

Q: How do I evaluate the sustainability of a CEF's distribution rate?

A: Look at the fund's sources of income. A sustainable distribution rate is typically supported by net investment income and capital gains. Avoid funds that rely heavily on return of capital, as this can erode the fund's NAV over time.

Conclusion of Closed-End Fund Investing: High Yield Income Strategy

Closed-end funds, especially when used within a high-yield income strategy, present a compelling opportunity for investors seeking to augment their income streams. However, success in this area hinges on diligent research, a clear understanding of associated risks, and a portfolio tailored to your personal financial goals and risk tolerance. By understanding the nuances of CEFs, their unique structure, and the various factors influencing their performance, you can make informed decisions and potentially unlock a rewarding source of income for your investment portfolio. Remember to consult with a qualified financial advisor before making any investment decisions.

Post a Comment