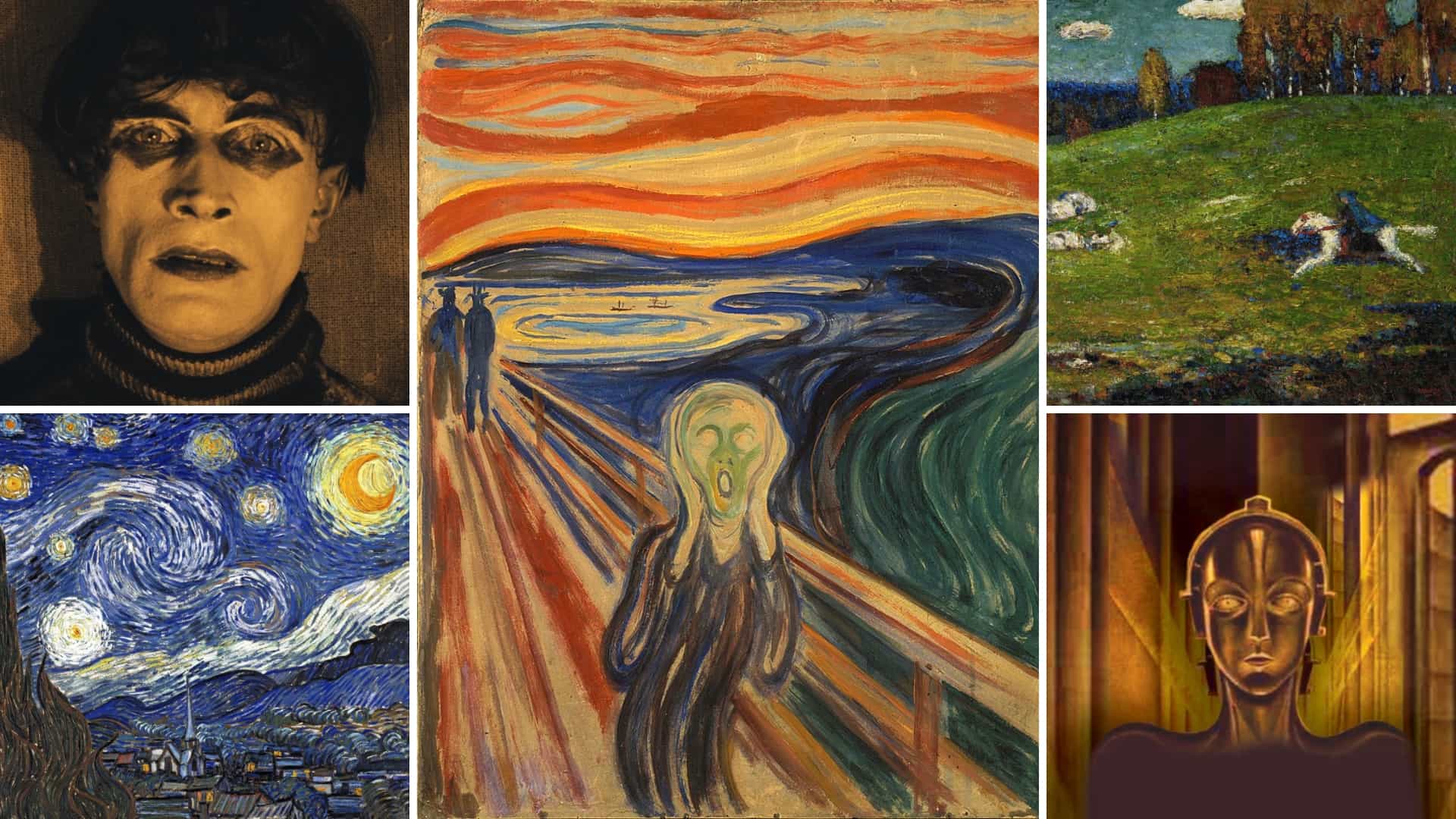

Art Investment for Passive Income: Creative Asset Strategy

Imagine earning income while indulging your passion for art. Sounds like a dream, right? What if that dream could be a reality? Investing in art isn't just for the ultra-wealthy; it's a viable, exciting avenue for generating passive income, provided you approach it strategically.

Navigating the art world can feel overwhelming. You might worry about identifying genuine pieces, understanding market trends, or securing your investment against damage or theft. And let's not forget the challenge of actually turning your art collection into a consistent income stream without sacrificing its intrinsic value. It seems like a long shot!

This article aims to demystify art investment as a passive income strategy. We will explore how to build a creative asset portfolio, understand the art market, and generate income through various methods like leasing, resale, and fractional ownership. We'll also cover the risks involved and how to mitigate them, empowering you to make informed decisions and turn your artistic interests into a rewarding financial venture.

In summary, this blog post will provide a comprehensive guide to art investment for passive income, covering topics such as building an art portfolio, understanding market trends, generating income through leasing or resale, mitigating risks, and making informed decisions. Key words include: art investment, passive income, creative assets, art market, leasing art, art resale, fractional ownership, art portfolio, art collection, art market trends.

My First Brush with Art as an Investment

I remember my first art purchase vividly. It was a small, unassuming watercolor at a local gallery. I wasn't thinking about investment potential; I simply loved the piece. It spoke to me. Years later, I was surprised to learn that the artist had gained considerable recognition, and my little watercolor had appreciated significantly in value. This experience sparked my interest in exploring art as a more deliberate investment strategy. I learned that my eye wasn't too bad, and I started digging deeper into the world of art investment. This led to researching artists, understanding market trends, and learning how to properly care for artwork. The initial process felt daunting. The art world seemed exclusive, filled with jargon and unspoken rules. But the potential rewards – both financial and personal – kept me motivated. The key, I discovered, was to approach it with a blend of passion, knowledge, and careful planning. Over time, I began to curate a small collection, not just based on aesthetic appeal, but also on potential for appreciation and income generation. Art investment is not just about picking pretty pictures. It's about understanding the market, the artists, and the economic trends that influence value. Building a passive income stream from art takes time, patience, and a willingness to learn, but it's a journey well worth taking for those who appreciate both art and financial security. Remember to consider factors like the artist's reputation, the artwork's provenance, and the overall condition of the piece when evaluating potential investments.

What Exactly is Art Investment for Passive Income?

Art investment for passive income is the strategic acquisition of artworks with the intention of generating ongoing revenue without active involvement. It's not just about buying art you like; it's about treating art as an asset capable of producing cash flow. The core idea is to leverage your art collection in ways that provide consistent earnings, such as renting out pieces to businesses or private collectors, selling prints or reproductions, or even participating in fractional ownership platforms. This approach requires a deep understanding of the art market, including identifying emerging artists, analyzing market trends, and assessing the long-term value of different art styles and mediums. You also need to consider the costs associated with owning and maintaining art, such as insurance, storage, and restoration. A well-structured art investment strategy can provide a diversified income stream that is relatively independent of traditional financial markets. However, it's important to remember that the art market can be volatile, and there are no guarantees of returns. Therefore, it's crucial to conduct thorough due diligence, seek expert advice, and be prepared for the possibility of fluctuations in value. This type of investment suits those who have a genuine interest in art and are willing to invest time and effort in understanding the market. It's not a get-rich-quick scheme, but a long-term strategy that can provide both financial rewards and the satisfaction of owning beautiful and culturally significant objects. Finally, the rise of digital art and NFTs opens up even more avenues for passive income through royalties and digital ownership models.

History and Myths Surrounding Art Investment

The history of art investment is as rich and colorful as the artworks themselves. For centuries, art has been a store of wealth and a symbol of status. From the patronage of the Medici family during the Renaissance to the rise of modern art collecting in the 20th century, art has always been intertwined with finance. One common myth is that art investment is only for the wealthy elite. While high-end masterpieces command exorbitant prices, there are many affordable avenues for entering the art market, such as collecting prints, supporting emerging artists, or investing in fractional ownership platforms. Another myth is that art is a guaranteed investment. The art market can be unpredictable, and values can fluctuate based on trends, artist popularity, and economic conditions. It's important to approach art investment with a long-term perspective and a realistic understanding of the risks involved. A further myth is that you need to be an art expert to invest successfully. While knowledge of art history, styles, and techniques is beneficial, it's not essential. With careful research, expert advice, and a keen eye for value, anyone can build a profitable art portfolio. Throughout history, art has proven to be a resilient asset class, often outperforming traditional investments during times of economic uncertainty. This is because art is a tangible asset that is not directly correlated to stock market fluctuations. However, it's crucial to remember that art investment requires patience, diligence, and a willingness to learn. Don't let the myths deter you from exploring the potential rewards of this exciting and rewarding asset class. Art investment offers a unique blend of financial gain and cultural enrichment, making it an appealing option for those seeking both profit and passion.

The Hidden Secrets of Successful Art Investment

The world of art investment is often shrouded in mystery, but there are some hidden secrets that can significantly increase your chances of success. One key secret is the importance of networking. Building relationships with artists, dealers, curators, and other collectors can provide invaluable insights and access to exclusive opportunities. Attending art fairs, gallery openings, and museum events is a great way to expand your network and stay informed about the latest trends. Another secret is the power of due diligence. Before investing in any artwork, it's crucial to thoroughly research the artist, the provenance of the piece, and its condition. Verify the authenticity of the artwork and obtain a professional appraisal. Don't rely solely on the opinions of others; do your own research and develop your own informed perspective. Furthermore, it's essential to understand the nuances of the art market. Different types of art, such as contemporary, impressionist, or old masters, have different market dynamics and potential for appreciation. Identify your niche and focus on building expertise in that area. It's also important to be aware of the legal and tax implications of art investment. Consult with a qualified art advisor or tax professional to ensure that you are complying with all applicable regulations. The art market is constantly evolving, so it's crucial to stay informed and adapt your strategies accordingly. Don't be afraid to experiment and take calculated risks, but always be mindful of your investment goals and risk tolerance. The hidden secrets of successful art investment lie in a combination of knowledge, networking, and due diligence. By mastering these elements, you can unlock the potential for significant financial rewards and personal fulfillment.

Recommendations for Starting Your Art Investment Journey

If you're considering embarking on an art investment journey, here are a few recommendations to help you get started on the right foot. First, define your investment goals. Are you primarily interested in generating passive income, or are you seeking long-term capital appreciation? Understanding your goals will help you focus your efforts and make informed decisions. Second, start small and build your knowledge gradually. Don't feel pressured to make large investments right away. Begin by collecting prints, supporting emerging artists, or investing in fractional ownership platforms. As you gain experience and confidence, you can gradually increase the size of your investments. Third, seek expert advice. Consult with art advisors, appraisers, and other professionals who can provide valuable insights and guidance. Don't be afraid to ask questions and learn from their expertise. Fourth, diversify your portfolio. Don't put all your eggs in one basket. Invest in a variety of art styles, mediums, and artists to mitigate risk. Fifth, be patient. Art investment is a long-term game. It can take years for artworks to appreciate in value. Don't expect to get rich overnight. Sixth, protect your investment. Insure your artwork against damage, theft, and loss. Store your art in a climate-controlled environment to preserve its condition. By following these recommendations, you can increase your chances of success in the world of art investment. Remember to approach it with a blend of passion, knowledge, and careful planning. The rewards can be both financial and personal. Consider researching online art platforms and auctions to broaden your horizons and discover potential investment opportunities.

Understanding Art Market Trends

Understanding art market trends is crucial for successful art investment. These trends reflect the collective tastes, economic forces, and cultural shifts that influence the demand and value of art. Analyzing these trends can help you identify promising investment opportunities and avoid costly mistakes. One key trend to watch is the increasing globalization of the art market. Artists from around the world are gaining recognition, and collectors are becoming more interested in diverse artistic styles and perspectives. This trend has created new opportunities for investing in emerging markets and discovering undervalued artists. Another important trend is the rise of online art platforms and auctions. These platforms have made art more accessible to a wider audience, and they provide valuable data on sales prices, market demand, and artist performance. Monitoring these platforms can help you stay informed about the latest trends and identify potential investment opportunities. Furthermore, it's essential to understand the role of collectors and institutions in shaping the art market. The preferences of influential collectors and the acquisitions of major museums can have a significant impact on the value of specific artists and styles. Following these trends can provide valuable insights into the future direction of the art market. Economic factors, such as inflation, interest rates, and economic growth, can also influence art prices. During times of economic uncertainty, art can be seen as a safe haven asset, which can drive up demand and prices. However, during economic downturns, art prices may decline as collectors become more cautious. Staying informed about these economic factors can help you make informed investment decisions.

Tips for Generating Passive Income from Art

Generating passive income from art requires a strategic approach. Here are some tips to help you turn your art collection into a revenue stream. First, consider leasing your artwork to businesses or private collectors. Many companies are willing to pay a monthly fee to rent artwork for their offices or showrooms. This can provide a steady stream of passive income without having to sell your pieces. Second, explore the possibility of selling prints or reproductions of your artwork. With the rise of online platforms, it's easier than ever to create and sell high-quality prints of your original artwork. This can be a great way to generate income from popular pieces without relinquishing ownership. Third, participate in fractional ownership platforms. These platforms allow you to sell shares of your artwork to multiple investors, generating income from the sale of shares and potentially from future appreciation. Fourth, consider using your artwork as collateral for loans. If you need access to capital, you can borrow against the value of your art collection. However, be sure to carefully consider the risks involved and ensure that you can repay the loan. Fifth, explore opportunities for licensing your artwork for use in advertising, product design, or other commercial applications. This can provide a lucrative source of passive income if your artwork is in high demand. Sixth, actively promote your artwork and build your brand. This can involve creating a website, using social media, attending art fairs, and networking with collectors and dealers. The more visible your artwork is, the more likely you are to generate income from it.

Understanding Art Appraisal and Valuation

Understanding art appraisal and valuation is critical for both buying and selling art. An appraisal is a professional assessment of the monetary value of an artwork, based on factors such as its authenticity, condition, provenance, and market demand. A qualified appraiser will have expertise in the specific type of art being valued and will follow established appraisal standards. The appraisal process typically involves a thorough examination of the artwork, research into its history and market comparables, and the preparation of a written report. This report will include details about the artwork, the appraisal methodology, and the appraiser's opinion of value. Appraisals are important for a variety of reasons, including insurance purposes, estate planning, tax deductions, and buying and selling art. If you are insuring your art collection, you will need an appraisal to determine the replacement value of each piece. If you are donating art to a museum or other charitable organization, you will need an appraisal to substantiate the tax deduction. The value of an artwork can fluctuate over time due to changes in market conditions, artist popularity, and economic factors. It's important to have your artwork appraised periodically to ensure that your insurance coverage is adequate and that you are making informed decisions about buying and selling. When selecting an appraiser, be sure to choose someone who is qualified, experienced, and independent. Ask for references and check their credentials. A reputable appraiser will be transparent about their fees and will provide a clear and understandable report. Understanding art appraisal and valuation is essential for protecting your investment and making informed decisions in the art market.

Fun Facts About the Art Market

The art market is a fascinating and often surprising world. Here are a few fun facts that might pique your interest. Did you know that the most expensive painting ever sold at auction is Leonardo da Vinci's "Salvator Mundi," which fetched a staggering $450.3 million in 2017? This sale shattered all previous records and cemented the painting's place in art history. Another fun fact is that the art market is largely unregulated, which can create opportunities for fraud and speculation. This lack of regulation also allows for a high degree of secrecy and opacity, making it difficult to track the true ownership and value of artworks. The art market is heavily influenced by trends and fashion. Certain artists and styles become popular, driving up prices, while others fall out of favor, leading to declines in value. This can make art investment a risky proposition, as trends can be unpredictable and fleeting. Art is increasingly being used as a form of alternative currency and a store of wealth. High-net-worth individuals often invest in art as a way to diversify their portfolios and protect their assets from inflation and economic instability. Many artists are now using digital technology to create and sell their work. This has led to the emergence of new art forms, such as NFTs (non-fungible tokens), which are unique digital assets that can be bought and sold online. The art market is a global phenomenon, with major art fairs and auctions taking place in cities around the world. These events attract collectors, dealers, and art enthusiasts from all corners of the globe, creating a vibrant and dynamic marketplace. Finally, the art market is constantly evolving, with new artists, styles, and technologies emerging all the time. Staying informed about these changes is essential for anyone who wants to succeed in the world of art investment.

How to Build a Creative Asset Portfolio

Building a creative asset portfolio requires a thoughtful and strategic approach. It's not just about accumulating a collection of artworks; it's about curating a diverse and balanced portfolio that aligns with your investment goals and risk tolerance. First, define your investment criteria. What types of art are you interested in collecting? What is your budget? What are your long-term goals for the portfolio? Answering these questions will help you focus your efforts and make informed decisions. Second, research the art market and identify potential investment opportunities. Explore different art styles, mediums, and artists. Attend art fairs, gallery openings, and museum exhibitions. Read art publications and consult with art advisors. The more knowledge you have, the better equipped you will be to make sound investment decisions. Third, diversify your portfolio. Don't put all your eggs in one basket. Invest in a variety of art styles, mediums, and artists to mitigate risk. A well-diversified portfolio will be more resilient to market fluctuations and individual artist performance. Fourth, focus on quality over quantity. It's better to own a few high-quality artworks than a large number of mediocre pieces. Quality artwork will generally hold its value better over time and have a greater potential for appreciation. Fifth, consider the liquidity of your assets. How easily can you sell your artwork if you need to access capital? Some types of art are more liquid than others. Sixth, protect your investment. Insure your artwork against damage, theft, and loss. Store your art in a climate-controlled environment to preserve its condition. Building a creative asset portfolio is a long-term endeavor that requires patience, diligence, and a willingness to learn. By following these steps, you can create a portfolio that provides both financial rewards and personal fulfillment.

What If You Make a Mistake?

Even the most experienced art investors make mistakes. The art market is complex and unpredictable, and it's impossible to predict the future with certainty. If you make a mistake, don't panic. The first step is to assess the situation and determine the extent of the damage. Did you overpay for an artwork? Did you invest in an artist who is no longer popular? Did you purchase a piece that is not authentic? Once you understand the nature of the mistake, you can begin to formulate a plan of action. If you overpaid for an artwork, you may be able to sell it at a loss or hold onto it in the hope that its value will eventually increase. If you invested in an artist who is no longer popular, you may need to accept the loss and move on. If you purchased a piece that is not authentic, you may be able to return it to the seller or pursue legal action. It's important to learn from your mistakes. Analyze what went wrong and identify ways to avoid making the same mistake in the future. Did you do enough research? Did you rely too heavily on the opinions of others? Did you let your emotions cloud your judgment? By learning from your mistakes, you can become a more informed and successful art investor. Don't be afraid to seek advice from art professionals. Consult with art advisors, appraisers, and other experts who can provide valuable insights and guidance. They can help you assess the situation, develop a plan of action, and avoid making further mistakes. Finally, remember that investing in art is a long-term game. There will be ups and downs, and not every investment will be a success. The key is to stay focused on your goals, learn from your mistakes, and continue to build your knowledge and expertise.

Listicle of Art Investment Passive Income Strategies

Here is a listicle outlining various strategies for generating passive income from art investments: 1.Leasing Art to Businesses: Rent your artwork to corporate offices, hotels, or restaurants for a steady monthly income.

2.Selling Prints and Reproductions: Create high-quality prints of your original artworks and sell them online or through galleries.

3.Fractional Ownership Platforms: Invest in or offer shares of artworks on platforms that allow multiple investors to own a piece, sharing profits.

4.Art-Backed Loans: Use your art collection as collateral for loans, generating income from interest if you lend the funds.

5.Licensing Artwork: License your art for use in advertising, product design, or other commercial applications, earning royalties.

6.Online Art Marketplaces: Sell art online through platforms like Saatchi Art or Etsy, reaching a global audience.

7.Art Storage and Security Services: Invest in art storage facilities or security services and earn income from storage fees.

8.Art Consulting and Advisory Services: Offer your art expertise to collectors, providing advice on buying and selling art for a fee.

9.Creating and Selling Art-Related Products: Design and sell products featuring your artwork, such as phone cases, apparel, or home decor items.

10.Teaching Art Classes or Workshops: Share your artistic skills by teaching classes or workshops, generating income from tuition fees. These strategies offer diverse ways to turn your passion for art into a source of passive income. Remember to carefully consider your investment goals and risk tolerance before implementing any of these strategies.

Question and Answer about Art Investment

Here are some common questions about art investment for passive income, along with their answers:

Q: Is art investment only for the wealthy?

A: No. While high-end art can be expensive, there are many affordable ways to enter the art market, such as collecting prints, supporting emerging artists, or investing in fractional ownership platforms.

Q: How can I generate passive income from art?

A: There are several methods, including leasing art, selling prints, participating in fractional ownership platforms, licensing artwork, and using art as collateral for loans.

Q: What are the risks of art investment?

A: The art market can be volatile, and values can fluctuate based on trends, artist popularity, and economic conditions. There is also the risk of fraud, damage, and theft.

Q: Do I need to be an art expert to invest in art?

A: While knowledge of art is beneficial, it's not essential. With careful research, expert advice, and a keen eye for value, anyone can build a profitable art portfolio.

Conclusion of Art Investment for Passive Income

Art investment for passive income presents a unique opportunity to combine your passion for art with a strategic financial approach. While it requires knowledge, diligence, and a long-term perspective, the potential rewards are significant. By understanding the art market, diversifying your portfolio, and exploring various income-generating strategies, you can turn your art collection into a valuable asset that provides both financial security and cultural enrichment. As you navigate the art world, remember to seek expert advice, stay informed about market trends, and always prioritize quality over quantity. With careful planning and execution, art investment can be a rewarding and fulfilling path to passive income.

Post a Comment